2025 Fall KFBM Observations

2025 Fall KFBM Observations

Published on October 31, 2025

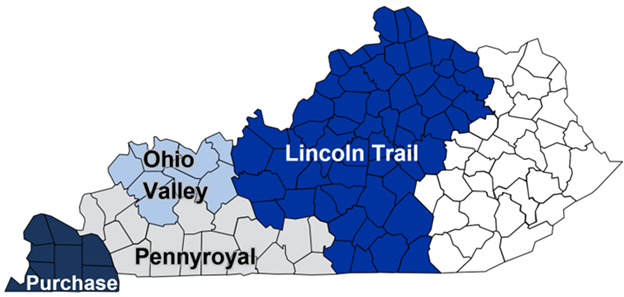

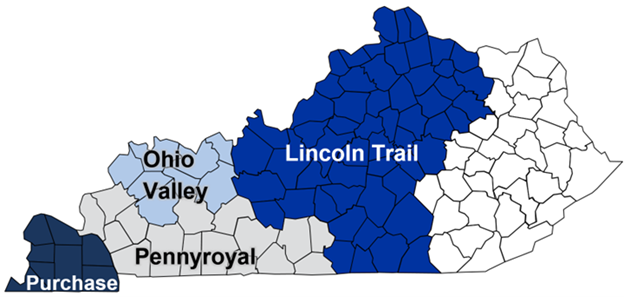

The Kentucky Farm Business Management Program is a program of the Department of Agricultural Economics at the University of Kentucky. Extension Specialists serve four Farm Analysis Associations working with cooperating members to improve farm management techniques and decisions through recordkeeping and analysis. Currently, KFBM serves 355 farms that are representative of 49 counties. KFBM specialists work closely with diverse farm cooperators, and this article will share some of the real-time observations that they have seen this fall.

Figure 1: KFBM Program Area Map

Weather and Production Report

Record-breaking rainfall this spring led to a difficult and extended planting season statewide. Some corn and full-season soybean acres were planted before the heavy spring rains, while other acres were planted later than normal due to the time required for many acres to dry out. Those early planted acres were further along in the growing season when the very hot and dry weather hit in late June and they were able to withstand those conditions better than the crops that were planted later. This has led to a wide range of yields across the state.

Projected corn yields vary drastically from region to region and when the corn was planted. The early corn planted in the Purchase region started out at over 200 bushels/acre, while the later corn dropped to as low as 120 bushels/acre. The Pennyroyal region has seen a lot of farms with over 200 bushels/acre and some farms claim this might be their best corn crop. Others in the Pennyroyal area have encountered average or subaverage yields due to drowned corn acres, disease pressure, and late planting from wet fields. The Ohio Valley region is projecting yields around 180 bushels/acre, which is below the five-year average. The corn in the Lincoln Trail region seems to be hurt the most by the wet spring and hot/dry summer with projected yields ranging from 70-170 bushels/acre. It is projected that most farms in that area will be closer to the 70 bushel/acre yield.

Soybean yields are also variable throughout the state. The Purchase region full-season soybean yields are projected to range from 60 bushels/acre for beans planted early and high 30s to low 40s for later planted beans. The Pennyroyal region projects similar results for full-season beans with some later planted beans yielding in the 20s. The Ohio Valley region projects full season beans to yield average around 55 bushels/acre which is below the five-year average. The Lincoln trail region projects full season bean yields to range from 40-60 bushels/acre. Double crop beans were greatly affected by the drought conditions and are projected to be less than 30 bushels/acre. For many farms, this is the second year in a row of “bad beans,” Farmers are critically evaluating bean varieties this harvest. Some farmers are saying it isn’t enough to assume early planted beans will consistently yield well, as many early planted fields didn’t do well with the swing from heavy rain to dry conditions in the summer.

Hay inventories should be less than average due to the impact of the late summer drought.

Tobacco yields will most likely be average in the area. It was notable that there were fewer severe thunderstorms that impacted the tobacco crop than prior years, although pop-up storms did localized damage in a few fields.

Financial News

Beef farms continue to be pleased with high prices, but many of them wonder how long the market can maintain these high prices. Many cattle farmers are using this strong market to decrease debt, make capital improvements, and replenish cash.

Dairy farms in Central Kentucky are facing low milk prices along with an increasing overall cost to produce milk. Future milk prices are not looking promising either. One cost that has not been a concern until recently is the cost of bedding. Some farmers have mentioned the concern of the continued increasing cost of herd comfort.

In the spring many farmers received economic assistance payments issued by the USDA through the Emergency Commodity Assistance Program (ECAP). The original payments only covered 85% of the total amount to be paid out. Farmers received the remaining 15% of their ECAP money at the end of September. Some farmers that had Federal Crop Insurance or Noninsured Crop Disaster Assistance Program (NAP) losses from 2023 and 2024 have received or will receive payments from the Supplemental Disaster Relief Program (SDRP).

Farmers in all regions continue to be concerned about current low crop prices and the bearish market outlook. These low prices, along with high and increasing input costs, have created another year of predicted farm losses. In addition to increased fertilizer, seed, and chemical cost, some farmers have expressed frustration with increasing liability and property insurance premiums. Interest rates have come down, which is a needed relief for operating notes, but long-term rates haven’t had much change. Most early cash flow projections have projected shortfalls for the 2025 crop year.

Many discussions this fall have revolved around increased borrowing on operating loans and the need to access cash from other sources. Some farmers have been able to get additional operating funds, while others have turned to CCC loans to replenish cash. There are other farmers that have sold and collected funds this fall for crops that would normally have sold next year. This may lead to other issues, such as increased tax liabilities with less cash available when taxes are due. Lenders continue to be concerned about two years of farm losses as well as the prospect of 2026 being the same.

Management Adjustments

Reliable labor continues to be a concern across the state. H-2A employers are pleased with the recent change in the wage survey tool used to calculate the Adverse Effective Wage Rate that may reduce H-2A wages, but there are concerns with how their employees will deal with the reduction in pay.

The reduction of tobacco acres has been felt across the state. Many farmers in the Purchase and Pennyroyal regions have tried to stay in production by adding back burley acres that had previously been eliminated. This decrease in acreage, combined with increased labor and employee benefit (such as housing and travel) costs and a challenging growing season has left many producers in the area evaluating if they can afford to continue raising tobacco. One factor that makes this decision even more challenging is that many of the tobacco producers also produce row crops and they rely on some of the H2A labor to assist in the row crop harvest. By eliminating tobacco, this could eliminate the need and ability to pay for this seasonal labor source. Many of these producers will be left with some tough decisions to make next year during fall harvest that will require new management decisions to be made.

Many farmers across the state are starting to look very closely at their rental contracts that are coming up for renewal. They are trying to determine what farms are making enough to cover input costs and which farms may need to be let go. In other instances, farmers are trying to renegotiate rental contracts that were increased during years of great profitability.

Despite a decrease in the used equipment market, many farmers are listing unused and unneeded equipment for cash needed to help make payments. In the Purchase region, there are rumors that there will be several tracts of land listed for sale following the harvest season as reduction of debt and increased cash resources are needed.

As wheat prices continue to look unfavorable for the 2026 marketing season, there continues to be a growth in canola production in the Purchase region. The 2025 area canola yields ranged from the high 50s to the low 60s. These yields, combined with the 2025 contracted price of over $12 has led to increased interest in raising canola for 2026. Canola acres in 2026 are predicted to be higher than those in 2025, despite around a dollar decrease in the contracted price.

As 2025 draws to a close, KFBM farmers continue to face a challenging landscape of weather-related variable yields, volatile markets, and rising input costs. While some isolated regions and farms have had strong yields, others have struggled with poor yields due to drought, disease, and late planting. Mixed production results, coupled with low commodity prices and high operating costs, are putting significant financial pressure on farms across the state.

KFBM farmers are proactively managing their operations by shifting crop strategies, reassessing rental agreements, leveraging strong livestock markets, and adjusting capital investment strategies. Still, concerns about cash flow shortfalls in 2025 and the outlook for 2026 are prompting tough financial and management decisions.

Recommended Citation Format:

KFBM Specialists. “2025 Fall KFBM Observations.” Economics and Policy Update 25:10, Department of Agricultural Economics, University of Kentucky, October 31, 2025.

Author(s) Contact Information: