Food Price Inflation Lingers

Food Price Inflation Lingers

Food price inflation continues to be headline news. Following a sustained period of minimal food price increases (averaging 1.3%) during the 2015-2019 period, annual food price inflation in the United States spiked at 10% in 2022 in response to a wide variety of factors including fallout from Covid-19 supply chain interruptions, military conflicts disrupting global trade, weather/disease issues, along with higher energy costs and labor supply challenges. Prices moderated in 2024, with food prices increasing 2.3%, but have been stubbornly persistent in 2025 --increasing by more than 3% on an annual basis over the past three months.

Historically low beef inventories amidst strong consumer demand for beef, along with continued disease pressure caused by avian influenza reducing poultry supplies are major factors contributing to food price inflation in 2025. Although retail egg prices have moderated recently, USDA forecasts that egg prices will be up around 25% in 2025, with aggregate retail beef prices 12% higher in 2025 compared to last year.

Tariffs have also impacted U.S. food prices in 2025 as the United States generally imports around 15% of the nation’s food supply. Recently, the Trump administration announced that it will no longer apply reciprocal tariffs on food items that are not produced in large quantities in the United States, such as bananas, coffee, tea, tropical fruits/juices, certain spices, and cocoa. Notably, beef was also included in that executive order lowering tariffs as the Trump administration continues to pursue trade policies to moderate domestic retail beef prices.

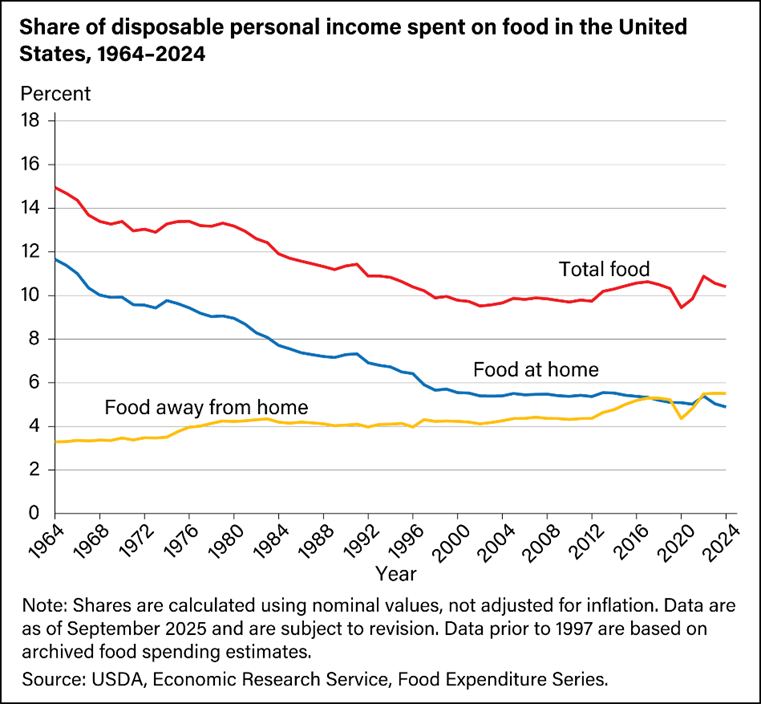

Despite sustained decades of higher nominal food prices, income gains and marketing efficiencies have led to Americans spending a smaller share of their income on food. While Covid disrupted the long-term downward trend, the latest USDA data reveal that U.S. consumers spend on average around 10% of their disposable income on food purchases – certainly one of the lowest percentages among nations worldwide. However, USDA data also reveal that the lowest 25% of income earners in the United States spend approximately 1/3 of their after-tax income on food.

In this midst of food price inflation, farmers and politicians are quick to correctly reveal that the farm value of the U.S. retail food dollar has diminished considerably over the years. In the 1950s, the farm value of the retail food dollar exceeded 40% compared to recent levels of approximately 15%. While increased concentration and market power of food companies and retailers are often alleged, one must also account for higher marketing costs beyond the farm gate (e.g. processing, packaging, branding, transportation, labor, etc.), increasing consumer preferences for convenience foods and non-conventional food items such as organic and non-GMO products, and greater food expenditures by U.S. consumers away from home.

Today, the farm value of a bag of potato chips or a box of corn flakes is generally only around 5% of the retail price. Items that do not require as much processing/packaging beyond the farm gate will have a much greater farm value. For example, historically the farm value of the retail beef dollar has generally hovered around 50%. During the supply disruptions of Covid, retail beef prices soared, while farm-level beef prices fell, causing the farm value for beef to drop below 40% of the retail beef price. Despite record high retail beef prices of late, the farm value of the retail beef dollar has rebounded back north of 50% so far in 2025. As a result of soaring retail beef prices, the Trump administration recently asked the Department of Justice to investigate market price outcomes evolving from the highly concentrated meatpacking industry – an inquiry that occurred during the first Trump administration and continued during the Biden administration resulting in no regulatory changes.

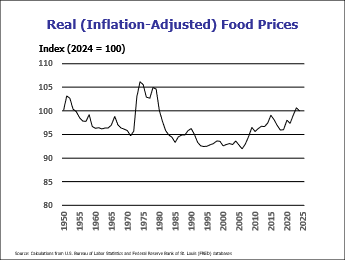

Amidst on-going food price inflation, one exercise that I ask students in my Ag and Food Marketing course is to have a conversation with someone over 55 years of age to discuss how food markets have changed over the years. One point identified in most interviews surrounds the escalating cost of food today vs several decades ago. It’s certainly true that food prices have increased significantly over time. For example, official U.S. government data indicates that a loaf of white bread cost around 50 cents in 1980 vs an average of $1.87 today, while a gallon on milk sold for $1.29 in 1980 compared to averaging $4.13/gallon today.

On average, nominal (observed) U.S. food prices have increased by nearly 300% since 1980. While food prices have been very volatile over the years, the inflation-adjusted (real) price of food today is roughly the same level as observed in 1980 (and also in1950) and considerably lower than real food prices during the inflationary period of the 1970s.

Recommended Citation Format:

Snell, W. “Food Price Inflation Lingers.” Economics and Policy Update 25:11, Department of Agricultural Economics, University of Kentucky, November 21, 2025.

Author Contact Information: